Notre podcast TAF avec Jeanne Deplus sur l’entreprise libérée et l’entreprise altruiste

J’ai eu le plaisir de participer au Podcast TAF de Jeanne Deplus, qui aborde des sujets d’actualité liés au monde du travail.

J’ai eu le plaisir de participer au Podcast TAF de Jeanne Deplus, qui aborde des sujets d’actualité liés au monde du travail.

Vous pouvez l’écouter ici.

J’ai eu le plaisir de participer au Podcast TAF de Jeanne Deplus, qui aborde des sujets d’actualité liés au monde du travail.

J’ai eu le plaisir de participer au Podcast TAF de Jeanne Deplus, qui aborde des sujets d’actualité liés au monde du travail.

Vous pouvez l’écouter ici.

By Sam Haddad

By Sam Haddad

24 Mar 2023

A Japanese pharmaceutical company is perhaps not an obvious place to look for a workplace revolution. But in the early 1990s, under the direction of its new president Haruo Naito, pharma giant Eisai quietly began to transform the way it did business. Instead of focusing on the bottom line, from then on Eisai would prioritise what it called “human healthcare”, first and foremost seeking to relieve the suffering of patients and their families.

Naito invited each department, from sales and marketing to finance, to rethink their business processes with this new goal in mind. For instance, instead of simply trying to sell drugs to doctors and hospitals, the sales teams focused on getting the right products to the right patients, who in the main were suffering from dementia or Alzheimer’s.

One sales manager in a poorly performing district, where GPs refused to meet with sales reps, set about educating older people on how to avoid falling – one of the major causes of hospital visits in that age group – through a series of lectures and demos on how to make their homes and habits safer.

A year later, when the manager tried to call the GPs again, they were eager to meet up, having heard good things about Eisai from their patients. The manager doubled her sales in six months. “She didn’t do anything to sell, but by changing the way she worked and by generating social value through caring about her clients, the result was economically successful,” says Isaac Getz, professor of leadership and innovation at ESCP Business School in Paris and co-author of L’Entreprise Altruiste (The Altruistic Enterprise).

It’s just one example – out of the thousands of businesses Getz has studied over the past 20 years – of a company turning social purpose into stronger business fundamentals, leaving it in a much healthier position in the long term. It is, he suggests, a valuable way to shore up a business against bumps in the road, and it’s a message that’s gaining traction in these uncertain times.

You can continue reading here

Andrew Hill a leading FT business and management editor took on the ESG debate, which earlier was carried under the names of CSR, Benefit Corporation, and more in his recent article.

Andrew Hill a leading FT business and management editor took on the ESG debate, which earlier was carried under the names of CSR, Benefit Corporation, and more in his recent article.

I am happy he used in his article several talks we had previously on the topics of liberated company (see his earlier opinion) and the altruistic enterprise.

If the article is not accessible, it can be read here.

The Altruistic Corporation: Reinventing companies by serving the common good and thriving as a result

Isaac Getz and Laurent Marbacher

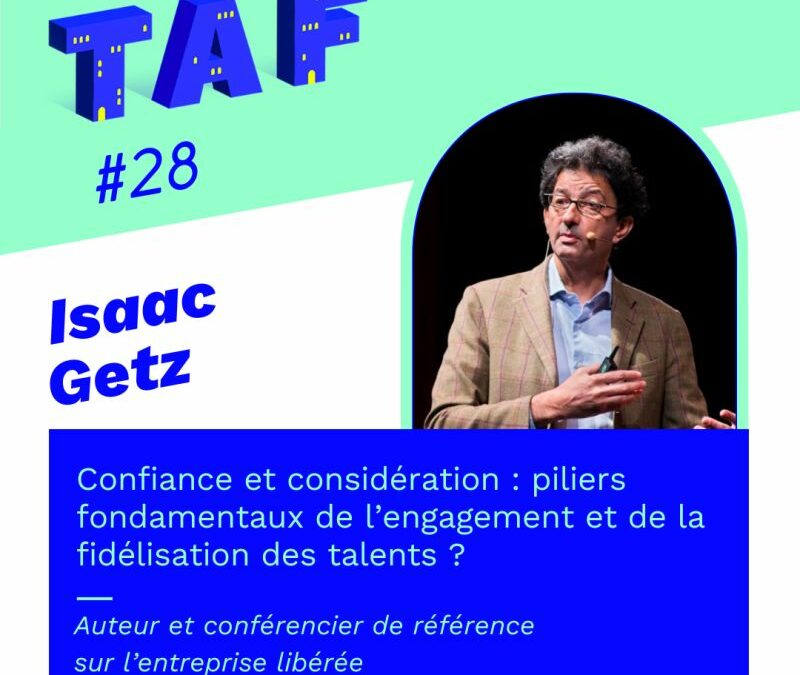

Adam Smith posited that by pursuing its economic self-interest, business creates social value. The data backs him up: from 1820 to 2001, per capita income rose twentyfold in the industrialized West (only sixfold in the rest of the world).[ii] This has meant that for the first time in human history, a significant portion of humankind could escape from living at mere subsistence level. Unfortunately—and increasingly—these benefits also come with collateral damage to our societies. There have been attempts to mitigate this damage for as long as modern business has existed,[iii] culminating in today’s approaches ranging from Corporate Social Responsibility (CSR) to the Triple Bottom Line (TBL) and Conscious Capitalism, all trying to generate both economic and social value simultaneously. But as John Elkington, the inventor of TBL, wrote recently: “Whereas CEOs… move heaven and earth to ensure that they hit their profit targets, the same is very rarely true of their people and planet targets. Clearly, the Triple Bottom Line has failed to bury the single bottom line paradigm.”[iv] The latest of these attempts, the Business Roundtable “Statement on the Purpose of a Corporation”[v] in which 181 of the top CEOs in the US committed to satisfy all their stakeholders, still does not show how this can be achieved simultaneously.

And what if the solution to social value generation by businesses lay in not pursuing profits at all? What if, as a result—and in a complete reversal of the sequence according to Adam Smith—such businesses outperformed their competitors economically? And what if it was a bank—among all the possible businesses—that was actually to put this into practice?

To continue reading

A la fin de 2020, juste avant un n-ième confinement Isaac a été invité au TEDxTours pour parler de l’entreprise altruiste.

En voici le résultat

Chronique dans la Harvard Business Review France du 5 septembre 2020

Entreprise à mission : et si Danone allait encore plus loin ?

Juste avant l’été 2020, l’assemblée générale de Danone a approuvé le statut de « société à mission », qui formalise pour les entreprises la poursuite de finalités non seulement économiques mais également sociales et environnementales. Ainsi, Danone devient la première entreprise à mission du CAC40 et la première multinationale cotée dans le monde à être une « benefit corporation » – son équivalent anglo-saxon.

L’annonce de Danone a suscité des réactions variées, mais aucune autre entreprise du CAC40 n’a manifesté d’intention de devenir à son tour entreprise à mission. On pourrait attribuer le caractère exceptionnel de l’engagement de Danone aux enjeux environnementaux gigantesques de son secteur. Cependant, la grande distribution – secteur aux mêmes enjeux – ne s’est pas encore déclarée désireuse de suivre les pas de Danone. Pas plus d’ailleurs que les grands groupes de l’énergie ou du transport. Une autre explication de la discrétion des grandes multinationales pourrait être que, dans l’univers des P-DG ou des investisseurs, l’idée de poursuivre des finalités autres qu’économiques reste encore totalement inacceptable.